Chapter 7: All about Elasticity

When prices rise or fall we know demand and supply will react. The law of demand tells us that if the price rises, the quantity demanded falls. If price falls, the quantity demanded rises. The law of supply tells us if the price rises the quantity supplied rises. If price falls, the quantity supplied falls.

What elasticity offers is a way to talk about how much the quantity reacts to the change in price.

Elastic means very responsive. Inelastic means not very responsive.

We have four main elasticities:

Price elasticity of demand

Price elasticity of supply

Income elasticity

Cross price elasticity

Price elasticity of demand is just the percentage change in quantity demanded for a given percentage change in price.

Price elasticity of supply is just the percentage change in quantity supplied for a given percentage change in price.

Income elasticity of demand is just the percentage change in quantity demanded for a given percentage change in income.

Cross price elasticity of demand is just the percentage change in quantity demanded of some Good A for a given percentage change in price of some Good B.

Let’s focus just on price elasticity of demand for now:

“percentage change in quantity demanded for a given percentage change in price” is just:

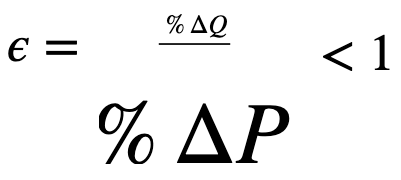

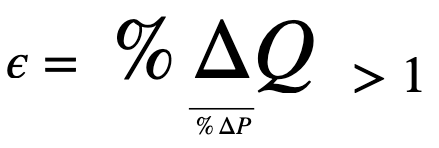

How to interpret elasticity values as elastic or inelastic? If the computed elasticity is greater than 1 in absolute value we say it’s elastic. If it’s less than 1 in absolute value we say it’s inelastic. We can take some logic from the fact that it’s just a fraction or ratio:

Inelastic: Big price change, small quantity change, fraction is smaller than 1:

Elastic: Small price change, big quantity change, fraction is larger than 1:

In order to use the definition to actually calculate an elasticity we have two main algebraic versions and a calculus version.

Point elasticity:

Mid-point elasticity or arc-elasticity:

Calculus point elasticity:

It doesn’t have to just be calculus, it’s really just literally multiplying ‘slope’ by the ‘point’ e.g. (Q, P) is a point on the graph. And dQ/dP is the slope of the demand curve (not the inverse demand curve)

We have the exactly same formulas for price elasticity of supply. The only difference is the elasticity will always be negative for demand, and always be positive for supply.

To generate income elasticity we just swap out the ‘price’ with ‘income’:

Point elasticity:

Mid-point elasticity or arc-elasticity:

Calculus point elasticity:

For income elasticity the sign is of primary importance:

Positive indicates normal good. Requires -/- or +/+

Negative indicates inferior good. Requires +/- or -/+

Zero would be invariant to income. Requires 0/?

The magnitude is relevant as it says how income elastic or inelastic the good is.

Cross Elasticity:

For cross price elasticity we just use the prices from one good and quantities from another:

Point elasticity:

Mid-point elasticity or arc-elasticity:

Calculus point elasticity:

For cross price elasticity the sign is of primary importance:

Positive indicates substitutes, requires +/+ or -/-

Negative indicates complements, requires -/+ or +/-

A value of zero indicates the goods are unrelated, 0/?

The magnitude matters as it governs the degree of responsiveness (how elastic or inelastic the relationship between the goods is).

See also: