Micro Exam #2

price controls, taxes, welfare economics, gains from trade, international trade, externalities, public goods

1. In the city of Metropolis, the local government imposes a rent ceiling of $1,200 per month on apartments. Before the price control, the equilibrium rent was $1,500 per month. What is the most likely outcome in the short run?

A) An increase in apartment supply as landlords invest in new buildings.

B) A shortage of apartments as the quantity demanded exceeds the quantity supplied.

C) A surplus of apartments as landlords struggle to find tenants.

D) No change in the apartment market because rent is still being charged.

2. A state government raises the minimum wage from $10 to $15 per hour. At $10 per hour, the quantity of labor demanded was 200,000 workers, while at $15 per hour, the quantity demanded falls to 180,000 workers. What is the most likely result?

A) Increased employment as businesses hire more workers at a higher wage.

B) No change in employment since workers now earn a fair wage.

C) Unemployment increases because firms hire fewer workers at the higher wage.

D) An increase in business profits as workers become more productive.

3. Following a natural disaster, the government caps the price of gasoline at $2 per gallon, despite the equilibrium price rising to $3.50 per gallon due to increased demand. What is the most probable consequence?

A) Gasoline shortages as quantity demanded exceeds quantity supplied.

B) Increased gasoline availability as suppliers provide more fuel.

C) No effect, since prices do not impact supply and demand.

D) Increased profits for gas station owners.

4. The government establishes a price floor for wheat at $8 per bushel when the equilibrium price is $6 per bushel. What is the likely market outcome?

A) A shortage of wheat as farmers produce less due to lower prices.

B) A surplus of wheat as farmers produce more than consumers are willing to buy.

C) No effect on the wheat market.

D) Lower prices for wheat due to government intervention.

5. A city imposes a $1 per-unit tax on electric scooters rented from sharing services. Before the tax, the equilibrium price per ride was $3. After the tax, consumers now pay $3.80, and rental companies receive $2.80 per ride. What does this reveal about tax incidence?

A) Consumers bear the entire burden of the tax.

B) Rental companies bear the entire burden of the tax.

C) Consumers bear more of the tax burden than rental companies.

D) Rental companies bear more of the tax burden than consumers.

6. The federal government imposes a $0.50 per-unit tax on bottled water. After the tax, the equilibrium quantity of bottled water sold decreases significantly. What does this suggest about deadweight loss?

A) Deadweight loss is high because demand is elastic.

B) Deadweight loss is low because demand is inelastic.

C) There is no deadweight loss because the government collects revenue.

D) The tax does not affect quantity sold.

7. A government implements a $2 per-unit tax on electronics. If sellers bear 75% of the tax burden, what does this indicate about demand and supply elasticity?

A) Demand is more elastic than supply.

B) Demand is more inelastic than supply.

C) Demand and supply have equal elasticity.

D) There is no tax incidence.

8. A government places a $1 per-unit tax on bus fares. If the quantity of bus rides purchased remains nearly unchanged, what does this imply about demand?

A) Demand is unit elastic.

B) Demand is elastic.

C) Demand is perfectly inelastic.

D) The tax has no effect on consumers.

9: The government imposes a per-unit tax of $0.50 per gallon on gasoline. Before the tax, the equilibrium price was $3 per gallon. After the tax, consumers pay $3.30 per gallon, and gas stations receive $2.80 per gallon. What can we infer about tax incidence?

A) Consumers bear the entire burden of the tax.

B) Gas stations bear the entire burden of the tax.

C) Consumers bear more of the tax burden than gas stations.

D) Gas stations bear more of the tax burden than consumers.

10: A city imposes a $2 per-unit tax on restaurant meals. If demand for restaurant meals is highly elastic while supply is relatively inelastic, who will bear most of the tax burden?

A) Consumers, because they always bear more tax burden.

B) Restaurants, because they have fewer alternatives and cannot easily reduce supply.

C) The government, since people will avoid paying the tax.

D) Both consumers and restaurants will share the burden equally.

11: A state government introduces a $5 per-unit tax on a luxury good. The pre-tax equilibrium price was $100, but after the tax, the price rises to $102, and sellers now receive $97. What does this indicate about the market?

A) Demand for the luxury good is highly elastic.

B) Consumers bear most of the tax burden.

C) The tax does not create deadweight loss.

D) Sellers bear most of the tax burden.

12: The government introduces a per-unit tax on sugary drinks to reduce consumption. Demand for sugary drinks is relatively elastic, and supply is relatively inelastic. What is the expected outcome?

A) A significant drop in sugary drink consumption.

B) No change in sugary drink consumption since taxes do not affect demand.

C) Consumers bearing the majority of the tax burden.

D) An increase in sugary drink prices equal to the tax amount.

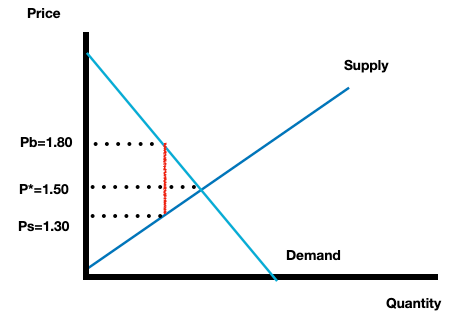

13: A competitive market for bottled water has an equilibrium price of $1.50 per bottle. The government imposes a per-unit tax of $0.50, causing the new equilibrium price to be $1.80 per bottle. What does this indicate?

A) Consumers bear most of the tax burden.

B) Producers bear most of the tax burden.

C) The tax has no impact on market outcomes.

D) There is no deadweight loss since bottled water is a necessity.

14: Instead of taxing electric vehicles, the government decides to offer a subsidy of $5,000 per car. If demand is highly elastic while supply is relatively inelastic, who benefits the most?

A) Consumers, as the full subsidy is passed on to them.

B) Producers, as they keep most of the subsidy.

C) The government, since the policy is revenue-neutral.

D) No one, as subsidies do not change market behavior.

15: In a competitive market for handmade furniture, the equilibrium price of a table is $500. The maximum price a consumer is willing to pay is $800, while the minimum price the producer is willing to accept is $300. What is the total surplus in this transaction?

A) $500

B) $300

C) $1,100

D) $800

16: In an unregulated competitive market, which statement best describes efficiency?

A) Total surplus is maximized.

B) Consumer surplus is always greater than producer surplus.

C) Producer surplus is always greater than consumer surplus.

D) Deadweight loss is maximized.

17: A tax of $3 per unit is imposed on a good. If demand is more inelastic than supply, who bears the larger burden of the tax?

A) Consumers

B) Producers

C) Both share the burden equally

D) The government

18: A steel factory emits pollution while producing steel. The market price of steel is $100 per ton, but the marginal external cost of pollution is $30 per ton. If left unregulated, what is the most likely outcome?

A) Overproduction of steel beyond the socially optimal level.

B) Underproduction of steel compared to the socially optimal level.

C) No impact on production since pollution is external.

D) Reduction in steel prices due to pollution.

19: A pharmaceutical company develops a new vaccine. The marginal private benefit (MPB) is $50 per dose, but the marginal social benefit (MSB) is $80 per dose due to reduced disease transmission. What is the likely market outcome without government intervention?

A) Underproduction of the vaccine.

B) Overproduction of the vaccine.

C) The market will provide the socially efficient quantity.

D) The price of the vaccine will automatically adjust to reflect MSB.

20: A local government imposes a $20 tax per unit of a good that generates a negative externality. If the marginal external cost of the externality is exactly $20 per unit, what is the effect of this tax?

A) It eliminates all production of the good.

B) It causes underproduction of the good.

C) It has no effect on production decisions.

D) It leads to a socially efficient outcome by internalizing the externality.

21: A beekeeper's bees pollinate a neighboring farmer's crops, increasing the farmer’s yield. If the farmer values the pollination service at $200 per season, and the beekeeper can provide it at a cost of $100 per season, what does the Coase Theorem suggest will happen?

A) The farmer will pay the beekeeper to maintain the bees, resulting in an efficient outcome.

B) The government must subsidize beekeeping to achieve efficiency.

C) The beekeeper will stop keeping bees unless mandated by law.

D) The external benefit is not addressed in private markets.

22: A factory’s marginal private cost (MPC) of production is $50 per unit, but due to pollution, the marginal social cost (MSC) is $70 per unit. What does this imply about market equilibrium?

A) The government should subsidize production.

B) The market produces too little relative to the socially efficient level.

C) The market outcome is efficient.

D) The market produces too much relative to the socially efficient level.

23: A city government builds a lighthouse to help ships navigate safely at night. The lighthouse is available to all ships regardless of whether they contributed to its cost. What type of good is this?

A) Private Good

B) Common Resource

C) Public Good

D) Club Good

24. A local town plans to fund fireworks displays through voluntary donations. However, many residents enjoy the display without donating. What economic issue does this illustrate?

A) Tragedy of the Commons

B) Free-Rider Problem

C) Rivalry in Consumption

D) Coase Theorem

25: A public fishing lake is open to all. Over time, fish populations decline due to overfishing. What economic principle does this illustrate?

A) Efficient Market Hypothesis

B) Free Rider Problem

C) Law of Demand

D) Tragedy of the Commons

26: A private gym charges a membership fee, allowing only paying members access to its facilities. However, one person using the equipment does not prevent others from doing so. What type of good is this?

A) Private Good

B) Public Good

C) Common Resource

D) Club Good

27. A restaurant sells gourmet meals that are available only to paying customers, and each meal consumed reduces the amount available for others. What type of good is this?

A) Public Good

B) Common Resource

C) Private Good

D) Club Good

28. A government introduces a toll road where only paying users can access it. During rush hours, the road becomes highly congested, reducing the benefits to users. What type of good does this toll road represent during peak times?

A) Public Good

B) Common Resource

C) Private Good

D) Club Good

29. A national park provides recreational opportunities to all citizens without exclusion. To maintain the park, the government funds it through general tax revenue. What is the economic rationale for this approach?

A) The park generates negative externalities.

B) The free market would efficiently fund and maintain the park.

C) Public funding prevents the under-provision of the park due to the free-rider problem.

D) The park should charge high fees to exclude non-payers.

30. A city’s groundwater supply is freely available for residents to use. Over time, the water level decreases significantly. What policy might best address this issue?

A) Increasing subsidies for water consumption.

B) Implementing a tax on excessive water usage.

C) Making the water supply completely free.

D) Allowing unlimited withdrawals by large farms.

31. After a natural disaster, emergency response services are provided to all affected individuals, regardless of their ability to pay. What type of good best describes these services?

A) Private Good

B) Common Resource

C) Public Good

D) Club Good

32. A river is heavily polluted because multiple factories dump waste into it without restriction. According to economic theory, what is one effective way to address this problem?

A) Allowing free dumping to promote economic growth.

B) Assigning property rights to the river and allowing trading of pollution permits.

C) Eliminating regulations so factories can compete freely.

D) Providing unlimited subsidies to polluters.

33. Why do countries benefit from specialization and trade based on comparative advantage?

A) They can produce all goods they need domestically.

B) They increase their total production costs.

C) They reduce their reliance on foreign goods.

D) They can consume beyond their production possibilities.

34. If Person A can produce 5 paintings or 20 sculptures per week, and Person B can produce 4 paintings or 12 sculptures per week, who should specialize in sculpture production?

A) Person A.

B) Person B.

C) Neither should specialize.

D) Both should produce sculptures equally.

35. If Country A can produce either 50 loaves of bread or 100 gallons of milk, and Country B can produce either 30 loaves of bread or 60 gallons of milk, which country should specialize in milk production?

A) Country A.

B) Country B.

C) Neither should specialize.

D) Both should produce milk equally.’

36. Suppose Country A can produce either 10 tons of steel or 5 tons of wheat, while Country B can produce either 8 tons of steel or 4 tons of wheat. Which statement is true?

A) Country A has a comparative advantage in wheat production.

B) Country B has a comparative advantage in steel production.

C) Country A has an absolute advantage in both goods.

D) Country B should specialize in wheat production.

37. What is the primary reason countries engage in international trade?

A) To eliminate competition from foreign markets.

B) To reduce employment opportunities domestically.

C) To increase tariffs and collect more tax revenue.

D) To obtain goods they cannot produce efficiently themselves.

38. A tariff is best defined as:

A) A tax on domestic goods sold internationally.

B) A restriction on the total quantity of goods imported.

C) A tax imposed on imported goods.

D) A limit on the amount of foreign investment in a country.

39. What happens when a country imposes a tariff on an imported good?

A) The price of that good increases whether imported or produced domestically.

B) Domestic consumers benefit from lower prices.

C) The supply of domestic goods decreases.

D) The demand for domestic goods decreases.

40. If the U.S. imposes a tariff on steel imports, which group benefits the most, and who is harmed?

A) Foreign steel producers benefit, foreign steel buyers are harmed.

B) Domestic steel producers benefit, domestic consumers of steel are harmed.

C) Domestic consumers of steel benefit, foreign producers of steel are harmed.

D) Foreign consumers of steel benefit, domestic producers of steel are harmed.

Here’s the YouTube solution: